Treasury Management Systems: A Primer

Treasury management systems (TMS) have evolved significantly over the last few years, in large part thanks to a maturing cloud market and the continued advancement of remote banking communication systems. For example, the growing impact of SWIFTNet, emergence of EBICS, and end-of-life cycle for the ETEBAC protocol have conspired to make TMS solutions a near necessity for companies of all types and sizes. Despite the growing need and market for treasury management, however, there’s still a great deal of confusion about the critical purpose and key benefits of using a TMS. Here’s what you need to know.

TMS Basics

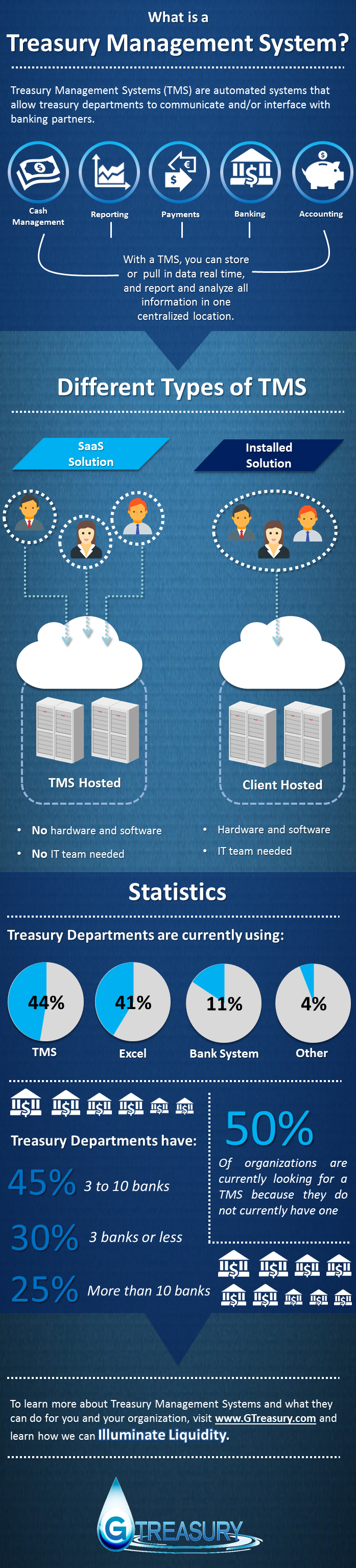

What exactly is a TMS? At their most basic, treasury management systems allow companies to automate critical financial operations — such as communication with banking partners or pulling cash flow data in real time — while ensuring finance data remains secure. As noted by Treasury Today, it’s easy to conflate TMS and ERP (enterprise resource planning) systems since they fill similar roles in your organisation

The key difference, however, is specificity: While ERP solutions now offer many treasury functions and banking links, they remain jack-of-all-trade tools designed to provide a “single system” approach to back-office functions. The complexity of treasury demands, however — such as the need for high-level risk management analytics, complex product coverage, and compliance with federal finance standards — makes a TMS the ideal solution for dedicated treasury support.

Local Vs. Hosted

If you’re in the market for a TMS solution, there are two basic “types” to consider: local and cloud-hosted. Local systems, sometimes known as “installed” TMS, are either developed in-house or purchased from trusted, third-party vendors and then installed on local servers. This option provides greater control over features and security protocols since the system is used exclusively by your organisation. The trade-off? You need superb third-party support or highly skilled local IT pros to ensure the TMS is properly managed day to day.

Cloud-based solutions are your other option. These software-as-a-service (SaaS) deployments offer a number of benefits such as speedy implementation and deployment, high availability and built-in provider security. If you’re comfortable putting the system at arm’s length, this is an ideal way to achieve TMS functionality without breaking the bank.

Key Advantages

Why choose a TMS? There are a number of key functions that directly impact your bottom line. For example, cash management gives you a comprehensive view of balances for both central and regional treasuries; liquidity management lets you easily determine cash on hand and availability of investment capital; while accounts management ensures that all transactions are reported, stored and available on demand for critical analytics. Ultimately, the right TMS removes the need for IT and Fintech staff to manually enter transaction or revenue data, in turn reducing your total error rate and increasing the amount of time your staff can dedicate to line-of-business projects.

Piece by Piece

Traditionally, standalone TMS solutions didn’t “play nicely” with other tech solutions, meaning IT staff were required to expend significant time and effort managing and troubleshooting treasury management systems. Cloud-based alternatives, however, offer the critical benefit of flexibility; they are both compatible with a wide range of ERP and in-house tools and yet separate from these tools, reducing the chance of a software conflict. In addition, cloud options let you pick and choose the services and functions that best suit your financial needs rather than forcing you to adopt an all-in-one solution.

Treasury management systems play a critical role in keeping corporate finances on track. The rise of flexible cloud-based solutions, meanwhile, provides both enhanced agility and control to maximise the efficiency and accuracy of all cash reporting.

Yvonne Chan, Director, Solutions Delivery, GTreasury

Yvonne Chan is the Director of Solutions Delivery team at GTreasury, a treasury management system provider. With over 15 years of experience in the treasury and technology industry, Chan has a proven track record in leading highly productive teams and exceeding client expectations.